The Ultimate Candlestick Patterns Trading Course (For Beginners)

This site contains affiliate links to products. We may receive a commission for purchases made through these links.

Candlestick Patterns

Welcome to FrankLegend.com where we review viral content. Today we will learn how to read candlestick patterns and be able to trade like a pro! Let’s get it.

What is a candlestick pattern?

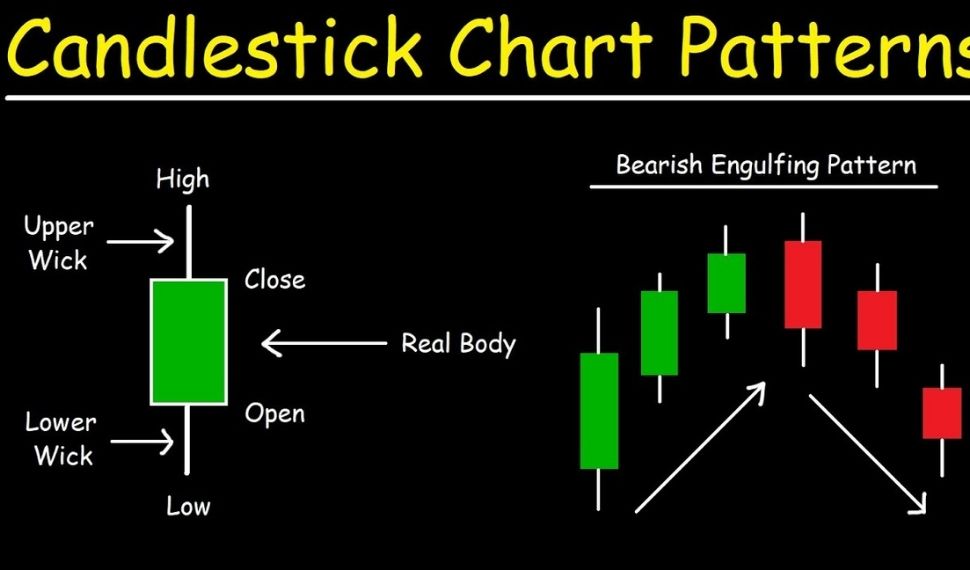

A candlestick pattern is essentially a method of reading a price chart. A price chart is basically where you see the price of a stock, currency pair etc. The key components of a candlestick chart is that it shows you four things.

- It shows you the opening price

- The price of the high of the session

- The low of the session

- The closing price

Candles are typically two colors, green or red. Sometimes you can change the color if you want but generally the most common colors are green and red. Green means good or BULL market. Red means Bad or BEAR Market.

How do you read a candlestick pattern?

A daily candlestick shows the market’s open, high, low, and close price for the day. The candlestick has a wide part which is called the “real body.” Candlesticks show you who’s in control and you must pay attention to the body, the wick and the body relative to the wick.

The body represents the price range between the open and close of that day’s trading. When the real body is filled in, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

How to NOT trade using candlestick patterns

1. Don't trade in isolation

You should never trade in isolation because it does not have a statistical edge in the markets. For example, if you happen to see a bullish hammer, you might go long. If you happen to see a shooting star, you might go short (Image Above). You cannot just jump into a trade with out seeing the big picture. You won’t make a lot of money in the long run and you could lose everything in the process.

2. Candlestick patterns are not a trading strategy

A candlestick pattern is not a trading strategy because it will not give you all the important elements that a trading strategy requires. While it can offer a possible entry and exit trigger, it won’t help you see the overall trending market. It’s like taking a test using only your notes and not the whole text book. You Morons lol

How to trade with Candlestick Patterns

Market structure: Market structure is simply support and resistance on your charts.

- Candlestick patterns combined with the market structure like support resistance, swing highs and lows, can give you entry points and entry triggers.

- You want to enter your trades after strong price rejection because this is where traders get trapped.

TAE framework & Patterns

TAE stands for

- Trend

- Area of Value

- Entry Trigger

The engulfing pattern. A bullish engulfing pattern is a pattern that forms when a small black candlestick is followed the next day by a large white candlestick, the body of which completely overlaps or engulfs the body of the previous day’s candlestick.

Hammer and shooting star. A shooting star occurs after a price advance and marks a potential turning point lower. An inverted hammer occurs after a price decline and shows a potential turning point higher.

Dragonfly and a Gravestone Doji: A gravestone doji occurs when the low, open, and close prices are the same, and the candle has a long shadow going up. The gravestone looks much like an upside down “T.” The implications for the gravestone are the same as the dragonfly.

Final Thoughts

Trading is a unique way of increasing our money. When you learn how to read and understand price charts, you will learn how to make money the right way and with less risk.

I hope you enjoyed this article and if you want to learn more check out this book called How to Day Trade for a Living: A Beginner’s Guide to Trading Tools and Tactics, Money Management By Andrew Aziz.

Share:

Victor Paredes

Victor Paredes is a contributor at FrankLegend.com and is based in Brooklyn. For inquiries reach out via email at victorhugoparedesx@gmail.com

Social Media

Most Popular

HOW AI AND CHATGPT WILL AFFECT THE STOCK MARKET IN THE FUTURE

Does Height Matter to Women in Dating?